A Downcycle in The Making

NEUTRAL

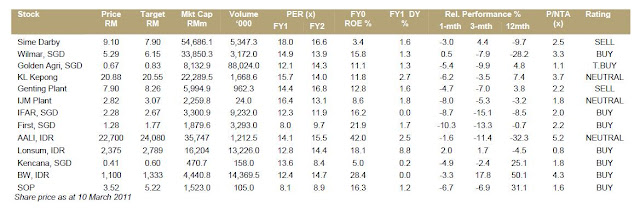

Palm oil price continued to weaken with the improved production outlook in 2H this year. At the same time, exports have been weak, suggesting that the current palm oil price is excessive and will inevitably lead to demand destruction. We believe that palm oil price already hit a peak in the 2008 – 2011 upcycle and is now in a downcycle, which will last some 6 to 9 months at the very least. As there have been no fresh catalysts to spur palm oil price further, prices have to correct to a level where demand starts to kick in. Maintain Neutral on the sector with selective Buys. Start of the downcycle. We are convinced that palm oil price had peaked when it hit RM3,967 per tonne (3rd month futures) in February 2011 and may have started a downcycle, judging from the recent negative price action. In our sector update last month, we indicated that our average CPO price assumption of RM3,200 per tonne this year implies that the commodity’s price will weaken to RM2,700.

Supply tightness mitigated by weaker demand. There are early signs of recovery in Malaysia’s production, with February production falling just 5.4% y-o-y compared to 19.9% in January. However, supply is still not out of the woods yet as Indonesia is still facing the 24- month effect of a drought 2 years ago in the upcoming 2Q. Still, demand has been weakening partly due to high prices, which allowed inventory to build up.

Market now convinced of production recovery. It appears that the market is now convinced that palm oil production will recover significantly in 2H this year. This is not surprising given the typical lag effect of dry weather on palm oil production. Our plantation consultant/agronomist has warned since last year of a potential bumper crop developing in the later part of 2011, particularly in Indonesia.

Discount to widen. Palm oil’s discount to soybean oil has been extremely narrow in the past 2 years but is now starting to widen. The spread, which now stands at USD78 per tonne, has room to widen as a typical discount ranges from USD100 – 200. Normalization of the spread to a mid-point of USD150 will bring palm oil price down to RM3,290 if soybean oil stays where it is.