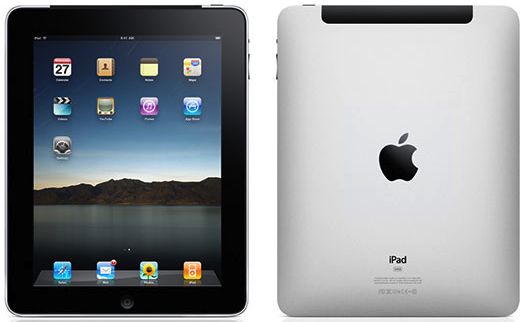

The Ministry Of Finance had on 20th March 2013, issued a letter stating that an individual is eligible for personal relief for the purchase of a personal computer under paragraph 46(1)(j) Income Tax Act 1967, which is defined to be a desktop computer, a laptop computer, Notebook and Ultrabook not used for the purpose of a business. Therefore, this means that other gadgets that are able to perform functions similar to a computer, for example tablet, iPad or handphone NO LONGER qualify for a deduction for the purchase of ‘personal computer’.

As a concession, any claim for personal relief other than a desktop computer, laptop computer, Notebook and Ultrabook which has been made until YA 2012 will not be withdrawn.

The new definition and tax treatment for deduction for purchase of a personal computer is effective from YA 2013 onwards, which means for those who have purchased their iPad or Samsung Tab earlier this year; sorry guys, no deduction :(

Source: http://malaysiantaxation101.com/2013/08/personal-relief-for-personal-computer-new-definition/

Subscribe to:

Post Comments (Atom)