1) OCBC booster account

| OCBC Booster Account | 4.45% |

|

What is the catch??

Celebrate a meaningful Malaysia with an additional 0.25% p.a. on your savings. Sign up for a new OCBC Booster Account and give your savings a boost when you combine it with your wealth.

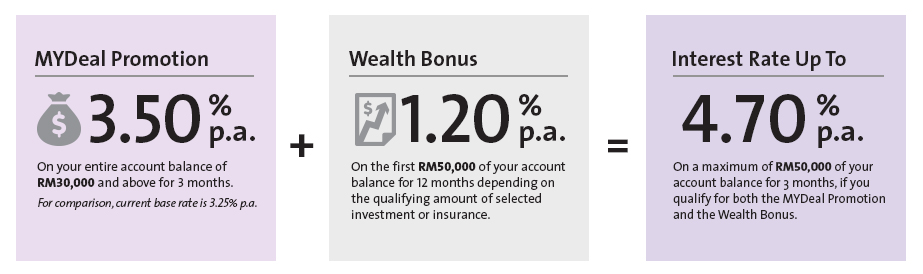

For instance, a new Booster Account with an account balance of RM30,000 and qualifies for the Wealth Bonus on the first RM50,000, the Effective Interest Rate for the 3-month MYDeal Promotion is 4.70% p.a. for the balance of RM30,000 and the Effective Interest Rate for a 12-month period is 4.51% p.a..

Terms and conditions apply.

The MYDeal promotion is valid from 1 August till 31 October 2018. For account balance of RM30,000 and above, you will enjoy a promotional rate of 3.50% p.a. for 3 months from date of account opening. Thereafter, you will enjoy the current base rate of 3.25% p.a. for account balance of RM30,000 and above. This promotion is not eligible for account balance below RM30,000. If you have invested or insured with OCBC Bank, you will still enjoy your bonus interest of 1.20% p.a. for the remaining 12 months. The wealth bonus is a separate promotion and valid until 31 December 2019. Only selected products are eligible for wealth bonus.

Terms and conditions apply.

The MYDeal promotion is valid from 1 August till 31 October 2018. For account balance of RM30,000 and above, you will enjoy a promotional rate of 3.50% p.a. for 3 months from date of account opening. Thereafter, you will enjoy the current base rate of 3.25% p.a. for account balance of RM30,000 and above. This promotion is not eligible for account balance below RM30,000. If you have invested or insured with OCBC Bank, you will still enjoy your bonus interest of 1.20% p.a. for the remaining 12 months. The wealth bonus is a separate promotion and valid until 31 December 2019. Only selected products are eligible for wealth bonus.

2) Alliance Bank SavePlus Account

Why save with Alliance SavePlus Account?

Alliance SavePlus Account is a current account that lets you enjoy high interest rates on your total account balances and a waiver for all transaction fees.**

Together, let’s build the alliance that accelerates your ambitions.

Alliance SavePlus Account is a current account that lets you enjoy high interest rates on your total account balances and a waiver for all transaction fees.**

Together, let’s build the alliance that accelerates your ambitions.

How it works?

**Only when a minimum monthly average balance of RM10,000 is maintained in the account.

| Total Account Balance (RM) | Interest Rate on Total Account Balance | Transaction Fee Waiver** |

| 0 – 20,000 | 0% | Yes |

| 20,001 – 100,000 | 1.8% p.a. | Yes |

| Above 100,000 | 3.5% p.a. | Yes |

**Only when a minimum monthly average balance of RM10,000 is maintained in the account.

3. Affin Islamic Wealth Saver-i

| AFFIN ISLAMICWealth Saver-i | 3.18% |

|

1 comments:

simple easy to understand guide for new account holder to decide which one is best in malaysian bank.

thanks from- KLSE stock market tips

KLSE Malaysia stocks