If you want to save enough for retirement, do the following:

- Forecast the future. I know it's tough to tell where you'll be in five or ten years. Sometimes, it's impossible. All the same, it's important to try. Having a plan reduces saving regret. The researchers found that “saving regret was highest among respondents who stated that they do not have a financial plan”. The longer a person's planning horizon, the lower their levels of regret.

- My comment: We can't forecast our future, therefore I save about 30% of my pay by living frugal. Example: I seldom buy cloth for my kids, normally get 2nd hand. I try to reduce my handphone bill each month, Me RM 10 and my wife RM 15 averagely.

- Plan for problems. You cannot predict when bad things are going to happen. You don't know if (or when) you're going to get cancer, a drunk is going to crash into your car, or a typhoon will wash away your beach home. You can, however, be relatively certain that something bad will happen sometime. Your best bet is to be prepared — just like a Boy Scout. Maintain an adequate emergency fund.

- My comment: I have prepare my emergency fund which can last for 6 months if I have no income. My target is to increase to 12 months.

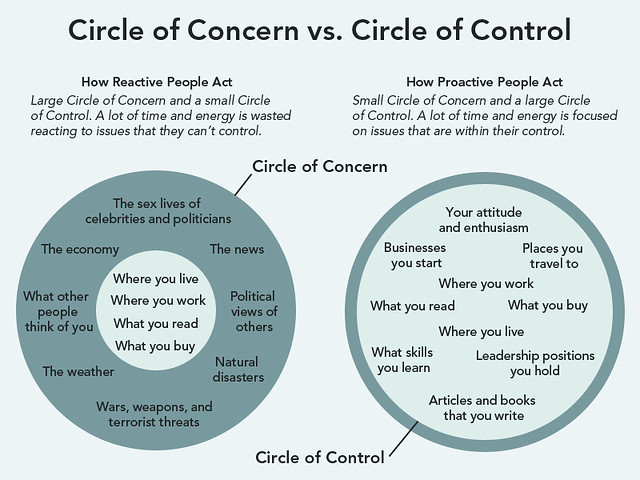

- Be proactive! There is never ever a reason that your Social Security benefits should come as a shock. The Social Security Administration issues periodic statements about estimated benefits. Plus, it's easy to look up projected benefits online. This is but one example of how you can take steps to prevent future surprises.

- My comment:In Malaysia, we have EPF. My planning is I can withdraw 2k each month from my EPF dividend when I reach 55 years old. Based on 6% interest, I need to have 400 k in my EPF at 55 years old.

- Master your money. “The relationship between saving regret and financial literacy is also strong,” the authors write. People with high levels of financial literacy experienced half as much regret as those at the lowest levels. To avoid disappointment later in life, learn everything you can about personal finance.

- My comment:Financial literacy is very lacking in Malaysia education. Luckily I learn from reading books and blog.

- Save more. Yes, this is an obvious solution to saving regret. I get it. But let's make this explicit: Your saving rate — the difference between what you earn and what you spend — is the most important number in your financial life. Saving rate isn't just vital for money nerds who want to retire early. It's a key factor for achieving any financial goal.

- My comment:My saving rate now is 30%, hope to increase to 40%.