If you buy will you be Chi Sin?

Ni Hsin Resources Ni Hsin Resources Bhd (NHR) Snapshot

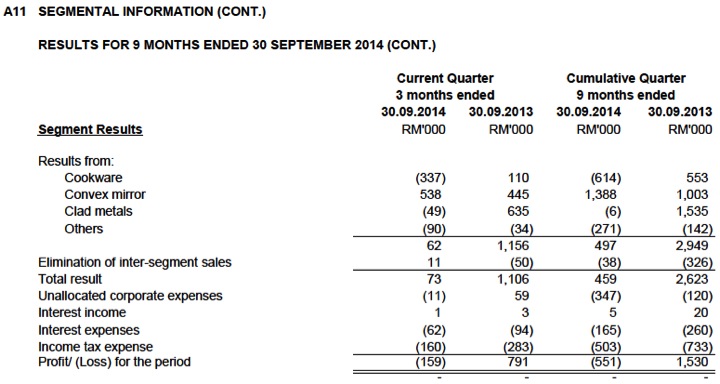

Quarter Result:

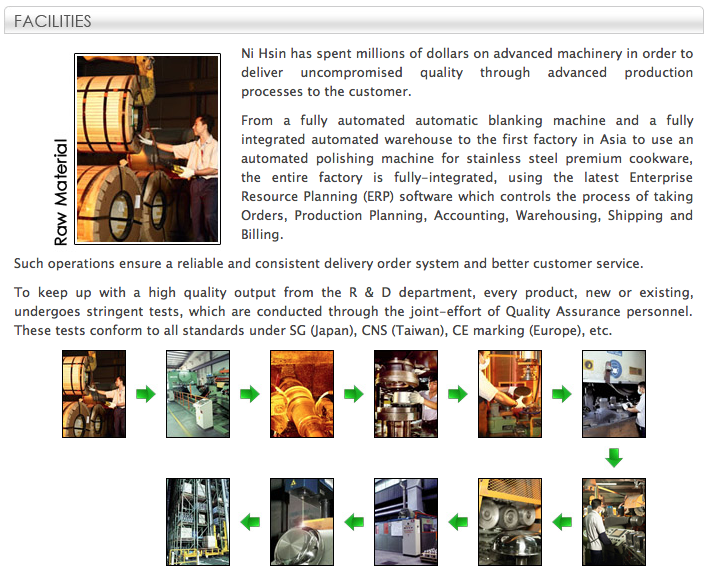

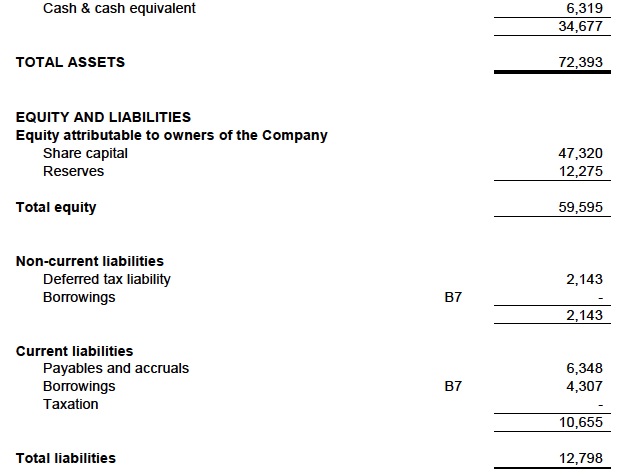

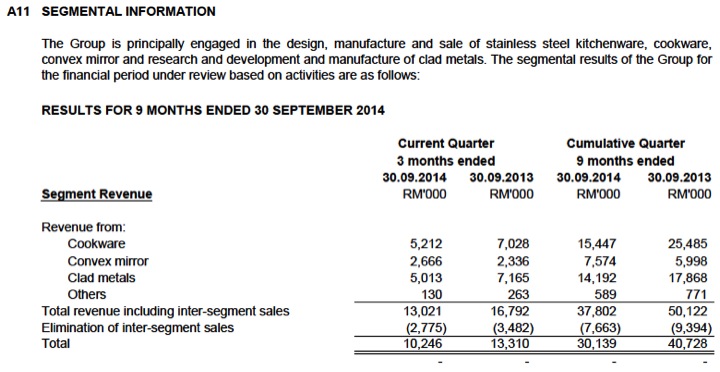

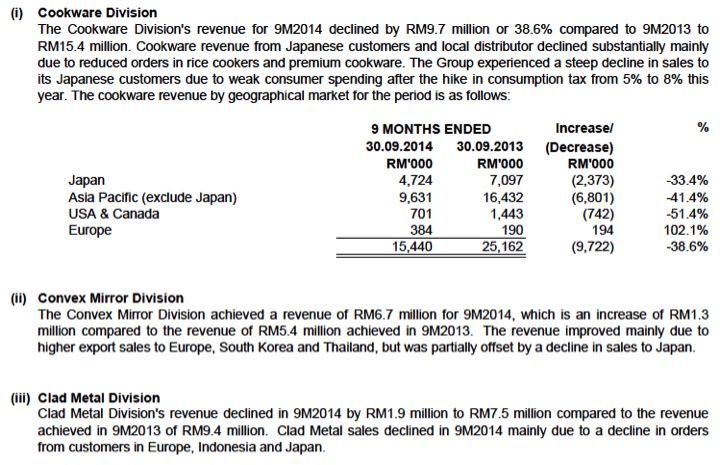

Healthy balance sheets :  Segmental breakdown by revenue :  Segmental breakdown by profit :  Segmental btreakdown by geographical region. It seemed that the bulk of the group's products are exported.  Comments (a) Small market cap of RM85 mil. Strong balance sheets. (b) All this while, has been operating at breakeven level. However, as most of its products are exported, earnings should improve in coming quarters as Ringgit has weakended substantially. Nevertheless, this has more or less been priced in as share price has rallied from 25 sen to 45 sen over past few months. (c) Despite better prospects, I am cautious about investing in this group. If a group has to rely purely on weak currency to boost its competitivenss, what will happen if the Ringgit return to normal ? |

2) Borneo Oil

Borneo Oil may trend higher after surpassing the MYR0.96 level in its latest session to mark a new multi-year high. Traders may buy –as a bullish bias could be present above this level – with a target price of MY1.08 followed by MYR1.15. The stock may consolidatefurther if it falls back below the MYR0.96 mark. In this case, support is anticipated at MYR0.885, where traders can exit upon a breach on closing. |

source: http://www.bfm.my/sm-salvatore-dali-malaysiafinance-angpow-stocks-150211.html